Uplyft Capital Reviews: Everything You Need To Know

Are you searching for business funding solutions but unsure about which provider to choose? Uplyft Capital has garnered attention as a financing partner for small businesses, but is it the right fit for your needs? This article will provide an in-depth overview of Uplyft Capital’s services, customer reviews, and how their offerings compare to other financial solutions.

If your business needs help with debt, CuraDebt offers a free consultation to guide you through effective relief options.

What Is Uplyft Capital?

Uplyft Capital is a Florida-based financial services provider specializing in business funding. Founded to support small and medium-sized businesses, the company offers solutions like merchant cash advances, business lines of credit, SBA loans, and equipment financing. With a streamlined application process and rapid funding, Uplyft Capital caters to businesses in urgent need of working capital.

Uplyft Capital’s mission is to empower businesses by offering personalized funding solutions with minimal delays. Its approach emphasizes convenience, with approvals often granted in hours and funds delivered as quickly as the next business day.

Do you need debt relief for your business?? CuraDebt is here for you.

How Does Uplyft Capital Work?

Uplyft Capital offers multiple financial products to meet the diverse needs of business owners:

- Merchant Cash Advances (MCA): Advance funds based on future receivables, ideal for businesses needing fast cash.

- Lines of Credit: Flexible funding solutions for recurring needs, requiring no collateral but a minimum monthly revenue of $8,000.

- Equipment Financing: Loans secured against the value of business equipment.

- SBA Loans: Long-term, low-interest options backed by the government for businesses with established credit histories.

- Invoice Financing: Provides funding against unpaid invoices, with lower interest rates but a processing fee.

Uplyft Capital aims to make funding fast, with approvals often within hours and funding available in 24–48 hours. This makes things easier for businesses.

Uplyft Capital Services

Uplyft Capital specializes in providing fast and flexible funding solutions to small businesses across the U.S. Their services focus on merchant cash advances (MCAs), which offer an alternative to traditional loans. Below is an overview of their services:

Merchant Cash Advances (MCAs)

Uplyft Capital’s core offering is merchant cash advances, which provide businesses with immediate working capital in exchange for a percentage of future credit or debit card sales. These advances are ideal for:

- Covering cash flow gaps.

- Purchasing inventory for seasonal demands.

- Expanding or upgrading business operations.

- Managing unexpected expenses like equipment repairs.

Quick Funding Process

One of the standout features of Uplyft Capital is their fast funding process. Once approved, businesses can access funds within 1–2 business days. This speed is crucial for businesses facing urgent financial needs.

Flexible Eligibility

Unlike traditional lenders, Uplyft Capital has lenient requirements:

- A minimum credit score of 450.

- At least six months in business.

- Proven monthly revenue of $12,000 or more.

Transparent Costs

Uplyft Capital charges no origination or monthly fees, focusing instead on a factor rate to determine the cost of funding. This transparency appeals to businesses looking for clarity in financial commitments.

Additional Support

Beyond funding, Uplyft emphasizes customer relationships, providing ongoing support and renewal opportunities for businesses that maintain consistent payment histories.

For businesses in need of a quick financial boost but struggling to qualify for traditional loans, Uplyft Capital offers tailored solutions. However, before deciding, consider alternative options like debt settlement, especially if managing debt feels overwhelming. CuraDebt provides personalized, no-obligation consultations to help you explore your financial relief options. Learn more by contacting us today!

Are you dealing with debt in your business? Find out why debt settlement could be your best option here.

Uplyft Capital Reviews

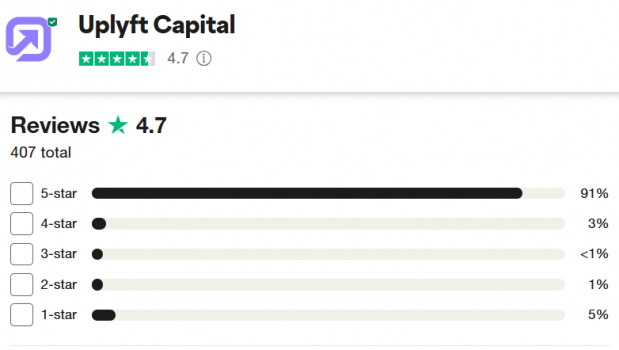

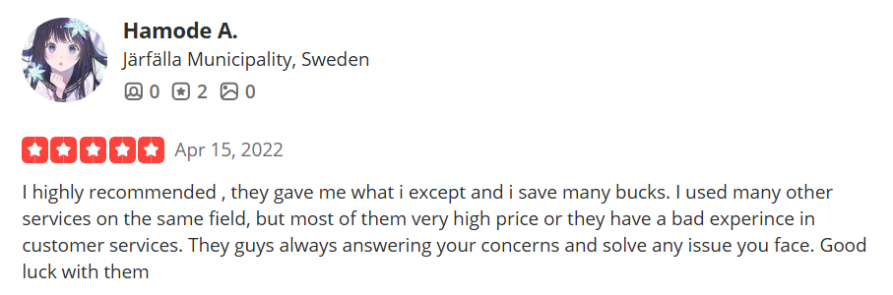

Trustpilot Reviews

Uplyft Capital holds an impressive 4.7/5 rating on Trustpilot. Many customers highlight the personalized support they received. However, a reviewer noted that email communication is something they need to improve.

- Positive Review: “So many worked hard to get funding for my business. Great experience. Thanks for helping me.”

- Positive Review: “I just want to give this company 5 stars because they truly deserve it. I needed some working capital for my business, and Uplyft came through for me in ONE DAY.”

- Negative Review: “As soon as I submit a form, they started bombarding me with automated emails and sales calls. However, I had very specific questions about the loan options. So, I emailed them. They never responded and keep sending me those unrelated emails asking to submit an application before answering any questions.”

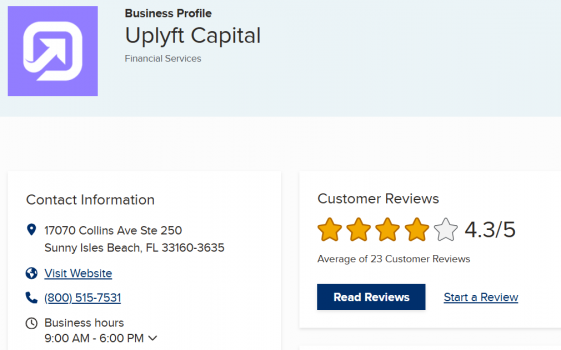

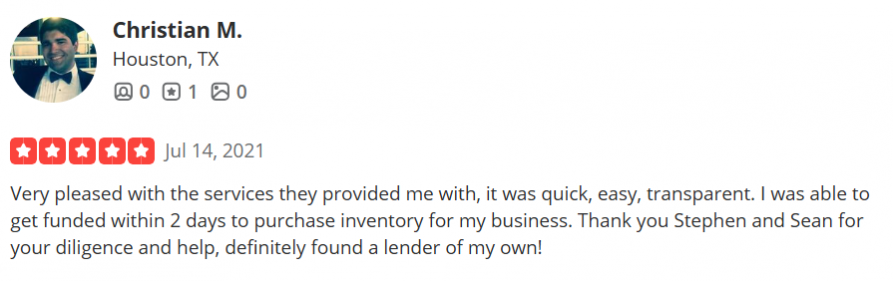

BBB Reviews

Uplyft Capital is rated 4.3/5 on BBB. Positive reviews commend their professionalism and efficiency. However, there are some complaints.

- Positive Review: “My experience was great! The man who helped me was very responsive. Even went out his way to find a better deal for me!”

- Positive Review: “My experience was so great. I was patiently walked through the whole process with detailed explanation.”

- Negative Review: “After the loan was deposited by the actual lender, Uplyft withdrew the same amount as origination cost from my account without authorization and called it “closing cost” that was not disclosed during any conversations. Now they don’t respond to emails nor resolve the issue via the phone.”

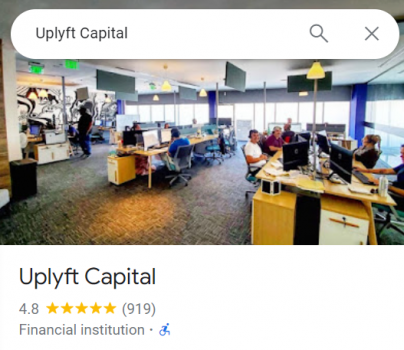

Google Reviews

Google users rate Uplyft Capital 4.8/5. Customers often praise the speed of funding and attentive staff.

- Positive Review: “Worked with these folks over the last few days. Highly responsive and ready to say YES to assisting me with short turn-around time.”

- Positive Review: “Loved dealing with my assigned officer! He was very professional and handled things in a pleasant business matter.”

- Negative Review: “I applied for a consolidation loan. Not wanting to, knowing I would be denied. They assured me I wouldn’t be denied with my credit since that is what I was applying for funds for, etc. I finally was talked into it, and sure enough, denied. Funny thing, they say it’s for inconsistent revenue. I’ll be in business 4 years next month and have had consistent revenue of 10,000+ monthly.”

What Customers Are Saying Across Platforms

Uplyft Capital has garnered a range of feedback across various platforms. Here’s an overview of customer sentiments from different sources:

- Themes: Mixed reviews. Some users appreciate the quick funding process, while others caution about high fees and perceived bait-and-switch tactics.

- Common Concerns: Interest rates being higher than advertised and dissatisfaction with customer service.

- Advice: Users frequently recommend reading terms carefully and comparing offers with other lenders.

Quora

- Themes: Limited discussions. When mentioned, users inquire about the legitimacy and reliability of Uplyft Capital.

- Common Concerns: Uncertainty about the company’s reputation and transparency.

- Advice: Seek multiple opinions and conduct thorough research before engaging with financial services.

Twitter (X)

- Themes: Few mentions, but posts often highlight aggressive marketing strategies.

- Tone: Short and often critical, with occasional praise for fast funding.

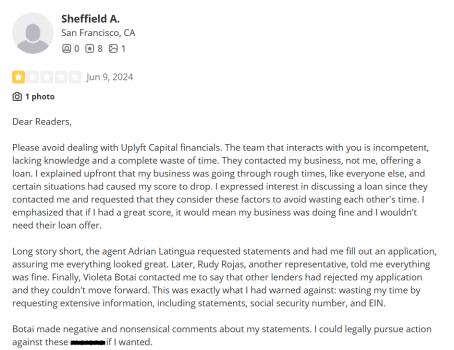

Yelp

- Themes: Mixed reviews. Some customers commend the efficiency and professionalism, while others express dissatisfaction with terms and customer service.

- Common Concerns: High fees and perceived lack of transparency.

- Advice: Prospective clients are advised to read all terms thoroughly and consider alternative options.

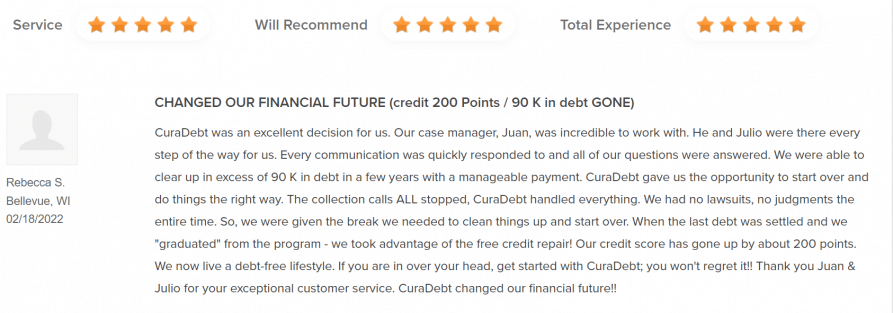

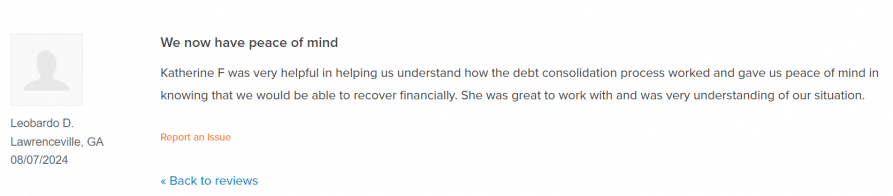

CuraDebt Reviews

If your business is drowning in debt, CuraDebt provides a lifeline. We’ve helped countless clients negotiate significant reductions in debt and regain financial stability.

With our proven track record, CuraDebt is a trusted partner for businesses seeking financial relief. Start your journey to freedom today with our free consultation.

Conclusion: Is This Company The Right Choice?

Uplyft Capital is an excellent choice for businesses seeking quick, accessible funding. Their positive reviews highlight their efficiency and customer focus, though potential borrowers should carefully review terms to ensure suitability.

If yourneeds help with debt, CuraDebt offers a specialized alternative through debt settlement. Contact us for a free consultation to explore a path to financial freedom. Let us help you turn your challenges into opportunities.