Debt can feel like an insurmountable challenge, but with the right help, you can find a path toward financial stability. One company that offers assistance with debt relief is DMB Financial. In this comprehensive guide, we’ll explore everything you need to know about DMB Financial, including how it works, its services, and customer reviews. By the end, you’ll have a clear understanding of whether DMB Financial might be the right choice for you.

Need a loan or help with debt relief? CuraDebt is here for you.

What Is DMB Financial?

DMB Financial, established in 2003, is a debt relief company headquartered in Beverly, Massachusetts. Specializing in debt settlement, the company aims to help individuals reduce their unsecured debts through negotiation. Over the years, DMB Financial has built a reputation for managing over $1 billion in debts for more than 30,000 clients. Their mission is to provide customized solutions to help clients regain control of their finances.

The company primarily focuses on unsecured debts, such as credit cards, personal loans, and medical bills, working directly with creditors to settle these debts for less than the original amounts owed.

Looking for a reputable debt relief company? Take our free consultation today!

DMB Financial Cost

On November 26, 2022, a review by DMB Financial was conducted by bestcompany.com. According to this review DMB Financial charges a fee of 21.5 percent of the clients total enrolled debt. The average fee in the debt settlement industry is 15 to 25 percent of the clients enrolled debt. DMB Financial charges 18 to 25 percent on average, which is a slightly higher minimum fee than most competitors. However, the company does not charge an upfront fee, which is the industry standard. This information was taken on July 10, 2023.

How Does DMB Financial Work?

DMB Financial employs a step-by-step process to help clients address and resolve their debts. Here’s how their program works:

- Initial Consultation:

DMB Financial begins with a free consultation where potential clients discuss their financial situation with a representative. This step allows the company to evaluate the client’s debt levels and financial goals.

- Enrollment in a Debt Settlement Program:

After the consultation, clients who qualify can enroll in a customized debt settlement program. This program is tailored to fit their specific needs and budget, focusing on reducing monthly payments while saving for settlements.

- Setting Up a Savings Account:

Clients are required to deposit a set amount into an FDIC-insured savings account each month. This account is used to accumulate funds for negotiating with creditors.

- Negotiation and Settlement:

Once enough funds are saved, DMB Financial negotiates directly with creditors to settle debts for less than the owed amount. Each settlement is approved by the client before funds are released.

- Completion:

The program typically lasts between 36 to 48 months, depending on the amount of debt and the savings rate.

While DMB Financial’s approach can help clients reduce their debts, it’s important to consider the potential impact on credit scores and the fees involved.

DMB Financial Services

DMB Financial offers specialized services to assist clients in managing their unsecured debts. Here’s an overview of what they provide:

Debt Settlement Services

The primary service offered by DMB Financial is debt settlement, targeting unsecured debts such as:

- Credit Card Debt: Negotiating with credit card companies to lower the total debt owed.

- Personal Loans: Reducing the balance of unsecured personal loans through settlements.

- Medical Bills: Assisting in managing and lowering unpaid medical expenses.

Additional Features

- Financial Education: The company provides resources to help clients better understand debt and financial planning.

- Customer Support: Clients have access to dedicated account managers who guide them through the program.

While the services are comprehensive, it’s important to inquire about fees during the consultation, as these can vary depending on the debt amount and program length.

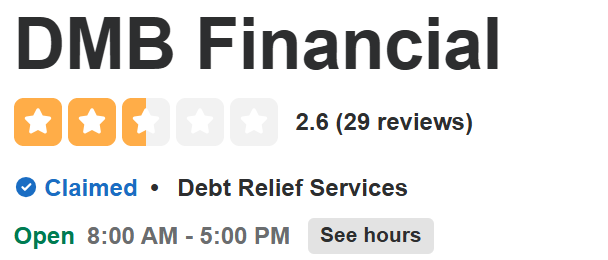

DMB Financial Reviews

Customer reviews offer valuable insights into a company’s reliability and performance. Here’s a breakdown of DMB Financial’s ratings across different platforms:

Better Business Bureau (BBB)

DMB Financial has an average of 4.86 stars on BBB, here is some feedback:

- Positive Review: “DMB Financial are a joy to work with, the process is seamless and they are life savers.”

- Positive Review: “Great and professional and made this journey well worth it – would easily recommend to anyone.”

- Negative Review: “The fees are ridiculously high. I regret signing up with them.”

Google Reviews

This score is similar to that of the BBB, which means that there is a high level of satisfaction.

- Positive Review: “I must say that my experience with DMB was great! They have been most professional and helpful in helping me to accomplish an awesome debt consolidation program with them.”

- Positive Review: “The people at DMB have been so helpful! they respond quickly to any questions I have and are always willing to help.”

- Negative Review: “When I entered the program they made me understand that in six months they would negotiate my debt and what has happened is that every day I receive calls from my creditors because they do not have the capacity to negotiate and pay my debts for me.“

Yelp Reviews

There are more mixed reviews on Yelp, let’s look at some of them:

- Positive Review: “DMB is amazing. Used them when I accumulated debt that weren’t originally my own and they relieved my stress and anxiety immensely. The staff is top tier! Highly recommended.”

- Mixed Review: “What was suppose to be a 4 1/2 year pay off for all of our bills, as promised, turned into 5 1/2 years. I also loss track of all the different agents we had in that time frame”

- Negative Review: “Very poor communication. I think they have a “revolving door” of employees. That’s never good.”

CuraDebt Reviews

If you’re exploring debt relief options, CuraDebt can be an excellent alternative to DMB Financial. CuraDebt specializes in personal, business, and tax debt relief services, offering a holistic approach to resolving financial challenges. With over two decades of experience, we’ve helped thousands of clients achieve financial freedom.

Here’s what clients have said about CuraDebt:

Ready to take control of your finances? Schedule a free consultation with CuraDebt today!

Conclusion: Is This Company the Right Choice?

DMB Financial has a strong track record of helping clients reduce unsecured debts. Their structured approach, combined with positive reviews on platforms like BBB and Google, indicates they are a reliable option for debt settlement. However, some clients have raised concerns about communication and high fees.

If you’re considering DMB Financial, it’s essential to weigh the pros and cons carefully. Alternatively, CuraDebt offers a broader range of services, including tax debt relief and business debt management. With a free consultation, personalized programs, and a commitment to client success, CuraDebt may be the ideal partner for your financial journey.

Don’t wait—take the first step toward financial freedom with CuraDebt today!