When it comes to finding reliable debt consolidation options, Lift Lending often pops up as a consideration. But is Lift Lending a legitimate company? In this comprehensive review, we’ll dive into what Lift Lending offers, its reviews from trusted platforms, and whether it’s the right choice for you. If you’re exploring debt relief options, keep reading to discover valuable insights, including why CuraDebt might be an alternative to consider.

What Is Lift Lending?

Lift Lending is a financial service provider specializing in personal loans, particularly for debt consolidation. The company aims to offer competitive rates and streamlined processes, making it a go-to option for borrowers with diverse credit histories. They provide loans ranging from $1,000 to $50,000, catering to those looking for manageable repayment terms and transparent rates.

Need a loan or help with debt relief? CuraDebt is here for you.

How Does Lift Lending Work?

Lift Lending simplifies the loan process:

- Application: Prospective borrowers fill out an online application form, submitting basic financial details and desired loan amounts.

- Approval Process: Lift Lending assesses creditworthiness but also claims to look beyond credit scores, making loans accessible to a broader audience.

- Disbursement: Once approved, funds are typically disbursed within 48 hours.

The company focuses on providing loans for debt consolidation, which means combining multiple debts into a single payment with potentially lower interest rates.

Lift Lending Services

Lift Lending specializes in debt consolidation loans, aiming to help individuals simplify their financial obligations by combining multiple high-interest debts into a single, manageable loan with a fixed interest rate. They focus on offering unsecured loans, which means you don’t need to use any assets as collateral, reducing personal risk. Here’s a breakdown of their primary services:

- Debt Consolidation Loans: Lift Lending positions itself as a solution for consolidating high-rate and high-balance credit cards into one loan. This service is designed to reduce monthly payments and lower interest rates, providing borrowers with financial relief and a clear pathway to debt repayment.

- Fast Funding: Lift Lending offers expedited processing, with approved funds typically disbursed within 48 hours after application approval. This quick turnaround is a highlight for borrowers looking to manage urgent financial needs.

- Transparent Practices: Lift Lending emphasizes transparency in their loan agreements, ensuring clients understand all terms before committing.

It’s important to note that Lift Lending exclusively offers debt consolidation loans and does not provide traditional personal loans. Their services are tailored specifically to assist individuals dealing with credit card debt or similar financial burdens

Do you want to know the difference between a debt consolidation loan and debt settlement? Watch here.

Lift Lending Reviews

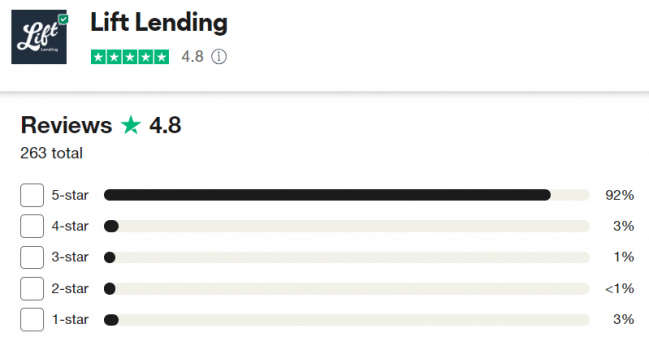

Trustpilot

Lift Lending boasts a high rating of 4.8/5 on Trustpilot, based on over 250 reviews. Here’s what customers are saying:

- Positive Review: “Help and guidance through the process was easy and accurate. What to expect and the schedule of events was carefully explained. Great job.”

- Positive Review: “Alex was phenomenal in explaining the process, showing us how much we would save each month and walking us through the details. No judgments there!”

- Negative Review: “I received a loan offer from this company. When I called, they instead took me to a loan settlement company and I was rushed into signing a contract that was not explained fully.”

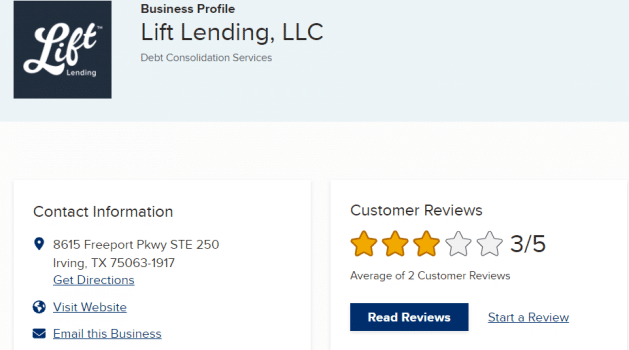

Better Business Bureau (BBB)

On BBB, Lift Lending has an A- rating, with mixed customer reviews averaging 3/5. Common feedback includes:

- Positive Review: “They were so helpful and really made a difference for me and my family. 5 stars! I would definitely recommend.”

- Negative Review: “I received the direct mail offering me a loan, and I was pre-Selected. However, it’s total bait and switch.”

Google Reviews

Google reviews average 5 stars, with users highlighting Lift Lending’s professionalism and customer support:

- Positive Review: “Gave a lower review before due to thinking I got hung up, but the next day I got a call back and an apology. It was a miscommunication issue due to a call drop. The caller helped me come up with a plan even though I did not qualify for their loan and was very informative and supportive in helping me as much as he could.”

- Positive Review: “Very helpful and patient!”

CuraDebt Reviews

If managing debt feels overwhelming, CuraDebt might be the solution you need. With over 20 years of experience, we specialize in:

- Personal Debt Relief: Tailored plans to reduce debt effectively.

- Tax Debt Resolution: Assistance with IRS-related challenges.

- Business Debt Relief: Helping businesses regain financial control.

Here’s what our clients have said:

You could be next! Schedule a free consultation with CuraDebt today.

Conclusion: Is This Company the Right Choice?

Lift Lending stands out for its high Trustpilot rating and accessible loan options, especially for those seeking debt consolidation. However, feedback on platforms like BBB indicates that they may switch what they offer once you have contacted them.

For those unsure about taking on new loans, consider exploring debt relief options with CuraDebt. With a proven track record and a commitment to personalized service, CuraDebt could help you achieve financial freedom without additional debt.

Ready to take control of your debt? Contact CuraDebt for a free consultation today!